It is time to turn off the hype machine and talk about real, legitimate reasons an ecommerce retailer should accept Bitcoin based in real facts. Disclaimer, I have been a Bitcoin fan since the beginning but lost most of my coins early on (yeah one of those) but strived to be impartial while writing this.

In the early 10’s I tried convincing a finance client to be the first one to install a Bitcoin ATM machine at a physical location as part of a big PR / link building campaign but ultimately got little buy-in from the executives where I worked (they actively laughed at the concept actually) and the client decided it was not the right fit for them. Fast-forward nearly a decade and Bitcoin’s price is still surging and dropping and grabbing headlines as it goes, typically the doom and gloom type of headlines, and I am still watching businesses make the same mistake of understimating it and losing out on potentially millions in earning.

Recently there has been a lot of movement in terms of empowering independent ecommerce merchants to accept Bitcoin across various shopping platforms and merchant processing platforms. We have gotten dozens of questions thanks to media coverage of companies like Tesla and MicroStategy in recent months asking if they should accept Bitcoin at their ecommerce store.

Instead of all of that hype though, the positive and the negative, I wanted to answer the most important question of them all for ecommerce store owners. That question is – Should your ecommerce business accept Bitcoin?

Will doing this actually help grow your business or will it just give you one more annoying thing to babysit?

Here are 6 reasons your ecommerce website should accept Bitcoin.

1. Consumers Are Using Bitcoin More and More to Buy Things

In Q1 of 2021 the online merchant system Square reported a record shattering $3.51 billion usd in Bitcoin sales via ecommerce merchants and real-world Square merchants. In Q1 of 2018 this was only $34 million usd. That’s a growth of 10,223% in only 3 years time or an average yearly growth of 3,407%.

2. The High Rate of Deflation

“A few years ago someone paid me $5,000 with Bitcoin for an order they placed. Today that same Bitcoin is valued at $20,000. It always brings a smile to my face when someone pays with Bitcoin.” – Gary Leland of 4 Minute Bitcoin, BitBlockBoom, and famous ecommerce entrepreneur of SoftballJunk.com

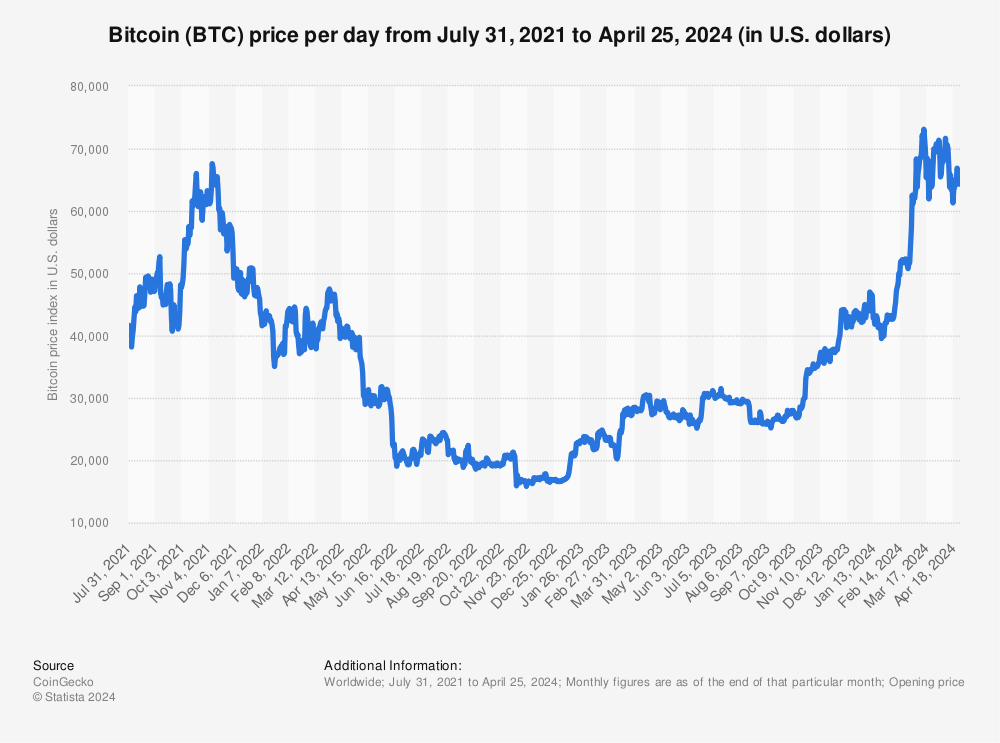

Bitcoin’s price has a now decade-long history of increasing by incredibly large percentages. There are very few assets that can say that. Since the price began getting listed on exchanges in 2013 the price of one Bitcoin has risen dramatically from roughly $132 to a price of $36,669.44 at the time this was written. This is an ‘all time’ increase of 27,679%, a mind blowing number for any asset. This does not include the price of $0.000001 in 2009 or the price of $1 in 2011 which produce even more insanely difficult to comprehend numbers.

One crazy way to look at this is to consider that if you purchased $100 usd worth of Bitcoins when they were $1 in 2011 and had them still today, they would now be worth approximately $3.6 million.

Usually the argument against accepting Bitcoin goes something like this “Yeah, but the price fell last week / month / year it will be worth zero soon enough!”. The history of Bitcoin’s price does not really back up this scary narrative though it based in some truth. The price is incredibly volitile, absolutely, and it has suffered some huge drops. But, when Bitcoin fell from its all time high price in 2017 if you had began accepting Bitcoin when it was at its lowest value following this event (around $3,617 usd) and sold at its new all time high value in 2021 of $63,558 usd your earnings would have risen 1,657%. If you started accepting Bitcoin sales at the precise moment of the 2017 all time high (a.k.a “the 2017 ATH event”) and then sold at the 2021 all time high your earnings would have risen 262%. That means an ecommerce merchant accepting Bitcoin between December 2017 and April of 2021 could have cashed in a return on investment of anywhere between 262% and 1,657%. Your bank account will never do that and your sales only if you go viral.

To get those earning though you have would need to be able to practice patience or as Bitcoiners call it “HODLing”. Selling off only the amount of the cryptocurrency that you need to in order to cover bills, inventory, etc…if that sounds too good to be true, that’s because in a way it is. At least in the USA exchanges are required to report earnings and you / your business will be taxed when you sell your Bitcoins off in order to raise funds to pay bills.

This does cause a bit of a conundrum for some small businesses, if you have too many sales where Bitcoin is used, transitioning your money out could cause additional taxation. Some countries are moving in a direction to eliminate this extra taxing but these could be years off since politicians tend to move slowly. If you do decide to accept Bitcoin, try to avoid selling in order to lock in the longer-term increase at the next all time high event. Also consider consulting a tax professional in your country/region familiar with Bitcoin.

3. Major Corporations are Holding Bitcoin as a Liquidity Strategy

Large publicly traded companies like Tesla and MicroStrategy are holding Bitcoin on their books as what are commonly referred to as “highly liquid assets”. Why do companies do this? Well it is actually part of an older strategy to ensure a company has financial assets that can be quickly liquidated (sold off for currency) should they need operational expenses in a pinch or if they want to go on an acquisition spree. Usually companies do this with things like Treasury Bills, but cryptocurrency arguably offers a much better alternative. Treasurys do not appreciate in value but are sold at a slight discount so they mature to face value. Cryptocurrencies such as Bitcoin can increase in value, can be quickly traded, and in some cases can be used as actual real world currency. That places Bitcoin in some situations as a type of asset known as a “cash-equivalents”. The only scary issue here is the potential decrease in value, for example Treasury Bills will not decrease in value.

“Tesla made it clear in its statement filed with its regulator the Securities and Exchange Commission that it sees bitcoin as a chance to diversify its cash and cash-equivalent holdings. – MarketWatch. February 9th, 2021“

Here’s a chart showing known corporate holdings of Bitcoin

4. You Can Gain Valuble Links

One of the more interesting things about Bitcoin (and some other cryptos) is how incredibly well it feathers in with SEO efforts or PR efforts. While it is getting harder and harder to use Bitcoin to snag headlines than it was back in 2012, it is still possible as both Elon Musk and MicroStrategy have shown us lately.

Some of the websites where getting links is possible include niche sites that serve the Bitcoin and cyrptocurrency community such as CoinMap, CoinDesk, CoinTelegraph, CryptoNews, and Bitcoin Magazine. You have to do something interesting with Bitcoin to get more media coverage as with any PR, but even just accepting Bitcoin can gain your ecommerce shop links from forums and social websites over time.

Make sure when you accept Bitcoin to have a PR or distribution strategy in place to get the word out and gain those valuble inbound links.

5. It Gives You an Attentive Audience Instantly

In many cases simply accepting Bitcoin can quickly get your brand attention from an audience of Bitcoin fans and users. As shown above these fans and users are increasingly spending their Bitcoins to buy things (at least via Square). Recently Tesla began accepting Bitcoin as payment and then a few weeks later abruptly reversed course. When they announced they would accept the cryptocurrency its price skyrocketed to a new all time high and then began to decline after they changed directions. For this Bitcoin fans largely turned against both Tesla and their CEO Elon Musk, even though both still are supposedly holding on to Bitcoin.

This shows a passionate fan base that will, hopefully, encourage friends and family and other Bitcoiners to do business with your ecommerce shop.

There are two caveats here. First, obviously the community’s passionate reactions have shown that your brand / company should tread lightly when starting out accepting Bitcoin, make sure it is something you want to do and not just a gimmick or it could come back to hurt you.

Second, you have to really buy into the entire concept of Bitcoin and work to be a member of the community for this to really have the impact (assuming you are not already internet famous of course). For example if you run a small shoe store you should be using your personal or brand Twitter to tweet about Bitcoin from time to time (at least one a week if possible) to show the community you are invested in the future of Bitcoin. You might even do small video chats, podcast interviews, and HARO responses about Bitcoin to help bolster your commitment and visiblity within the community.

6. It Opens Up Interesting Specials and Deals

If we are being honest, the tools for really unlocking the potential of Bitcoin and other cryptocurrencies are still in their infancy. There is so much more potential that has yet to be tapped. For example there could be a Bitcoin payment app that gives users a discount based on the price BTC/USD price at the time of purchase in order to encourage shoppers to purchase more with Bitcoin. Why would this be a good thing? Back to point #2, the deflation rate. If you wanted to gain a bunch of highly liquid assets for your reserves, lowering your pricing for Bitcoin shoppers only could help you gain more Bitcoins or Satoshis which would be worth anywhere between a few hundred and a few thousand percent more than when you first accepted them in a few years time (if the price increases continue). Your business would basically be investing by simply performing normal sales functions.

While none of this is a reality quite yet, you could in theory offer such deals manually or find other creative ways to make the offers to Bitcoiners by providing coupon codes for them to use or doing something else special for the Bitcoin community.

Conclusion

If you are ready to accept Bitcoin and you want to work with a forward thinking Shopify SEO agency or WooCommerce SEO agency we would love to work with you and bring your store to the Bitcoin masses. We are not just experts at SEO but also at integrating BTCPay, OpenNode, Coinbase Commerce, BitPay, GoCoin, Square, and other payment solutions that allow you to easily accept Bitcoin and power your marketing to this passionate community. Get in touch and lets start building a successful Bitcoin or Crypto marketing campaign for your ecommerce shop today!

What do you think? Agree or Disagree? Are there other reasons an ecommerce merchant should accept Bitcoin? Chat with me in the comments below. Or, if you write a rebuttal article refuting anthing I have published I will happily review it and link to it from here for others to find.